CARING MANAGEMENT CONSULTANTS

Your Trusted Partner in Enforcement & Recovery Solutions

End-to-end recovery and enforcement services built on experience and regulatory discipline.

0

k+

Assignments

0

Cr+

Total Recovery

0

+

Banks & Institutions

0

+

Years of Experience

[ OUR PRESENCE ]

Serving Major Cities Across India

[ OUR SERVICES ]

Comprehensive Recovery & Enforcement Services

Debt Collection

Systematic recovery of outstanding dues from individuals & businesses through structured collection processes on behalf of creditors.

Asset Recovery

Identifying, tracing, and recovering movable and immovable assets that have been concealed, misappropriated, or unlawfully retained.

Legal Enforcement

Executing legal actions including litigation support, court orders, and judgments to enforce recoveries and secure creditor interests.

Compliance and Due Diligence

Ensuring all recovery and enforcement activities strictly comply with applicable laws, regulatory guidelines, and institutional frameworks.

Custodial Services for Seized Assets

Managing, safeguarding, and maintaining seized assets under court or authority directions during ongoing legal proceedings.

Seizure of Assets as per NCLT Orders

Executing asset seizure and possession strictly in accordance with NCLT orders and applicable statutory requirements.

Security Services

Providing trained security personnel and asset protection services to safeguard seized properties and prevent unauthorized access or misuse.

Newspaper Publication

Handling statutory and legal notice publications across approved newspapers with nationwide reach through dedicated compliance teams.

Valuation Services

Delivering accurate and defensible asset valuations to support informed decision-making during recovery, enforcement, and resolution processes.

Expertise in Enforcement & Recovery

Specialized expertise delivering lawful, efficient recovery across diverse financial scenarios.

Proven Success in Challenging Cases

Consistent recovery outcomes in complex, high-value, and sensitive enforcement cases.

Comprehensive Services Tailored to Your Needs

End-to-end recovery, compliance, and support services customized for client requirements.

Strong Compliance & Ethical Practices

Operations driven by regulatory adherence, transparency, and ethical recovery standards.

WHY CHOOSE US

Your Partner in Rebuilding & Restoring Property Value

Trusted by banks and financial institutions for compliant, reliable and result-driven recovery and enforcement solutions across India.

[ OUR CLIENTS ]

Trusted by Leading Organizations

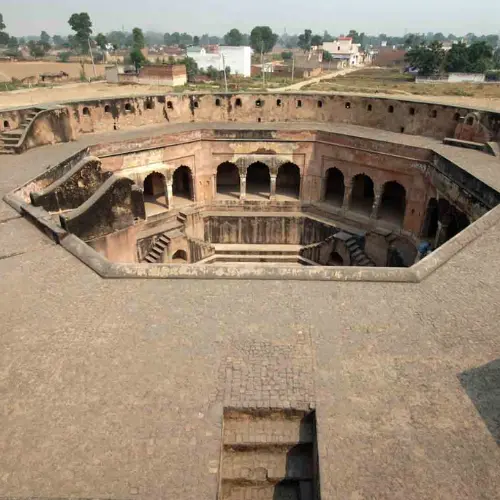

REPOSSESSED PROPERTIES

Benefits of Repossessed Properties

Discounted Property Pricing

Purchase repossessed properties at prices significantly lower than prevailing market rates.

Regulated Buying Process

All property purchases follow clearly defined procedures under SARFAESI Act or IBC guidelines.

Clear Bank-Owned Titles

Property title rights remain with the bank, ensuring legal clarity and secure ownership transfer.

Bank-Handled Registration

Property registration is facilitated directly by the bank, ensuring transparency and compliance.

Loan Availability Support

Eligible buyers can avail loans after the sale certificate is issued by the bank.

Secure Cashless Transactions

All transactions are cashless and processed through authorized banking channels only.

Transparent Pricing Structure

Properties are registered strictly at the price paid, ensuring fair and transparent documentation.

Flexible Buyer Eligibility

Properties can be purchased by individuals, companies, or groups as per eligibility norms.

OUR PROPERTY PORTFOLIO

Explore Property Categories

CLIENT TESTIMONIALS

What Our Clients Say About Us

M/s Caring Management Consultants Pvt. Ltd. is empanelled with our bank as a recovery agent. Their conduct, professionalism, and service delivery have been satisfactory throughout our association.

★★★★★

★★★★★

Allahabad Bank

M/s Caring Recovery Management Pvt. Ltd., under the leadership of Mr. Gyanendra Kumar, has been working with us as an Enforcement and Recovery Agent since 2017. Their performance and execution have consistently been satisfactory.

★★★★★

★★★★★

Bank of Baroda

M/s Caring Management Consultants Pvt. Ltd., empanelled as an Enforcement Agent with our bank, has delivered satisfactory performance and reliable service outcomes.

★★★★★

★★★★★

Bank of India